Reward Distribution

Reward Pool Structure and Process

Infinity Rising will incentivize platform participants through its reward pool.

The specific actions eligible for incentives and the corresponding incentive amounts can be influenced by governance.

The Infinity Rising year will be divided into Seasons (each season = 13 calendar weeks).

Rewards are allocated per season using the reward pool.

Initial incentivized actions include*:

- 10% for staking $RISE

- 18% to liquidity providers that stake the LP token (see eligible pairs below)

- 17% to node operators

- 55% to in-game rewards, highlighting the commitment to rewarding skill and participation

The rewards will be distributed from a fixed supply reward pool at variable frequencies, based on the outstanding tokens in the pool.

Prior to the start of each season, a variable percentage, not exceeding 0.025% (2.5 bps), will be applied to the rewards pool balance to estimate a daily average of rewards to be distributed throughout the season.

For this calculation, the starting Rewards Pool = Gameplay Rewards balance + Staking & Farming balance (as displayed in Token Metrics).

This setup means that:

- The reward pool can never be consumed (rewards are a % of the outstanding pool).

- The reward pool decreases over time.

- The mechanism ensures capped inflation and works with fixed supply tokens (unlike perpetual inflation).

Distribution Formula

The rewards will be distributed based on the following formula:

Allocation of the Reward per User = (Contribution per User over the defined time period) / (Sum of the Contributions for All Users in the System for the defined time period)

Contribution Components

The user contribution is defined as follows (based on the items above):

-

Number of LP tokens staked, weighted by duration (Multiplier)

LP tokens are obtained on a DEX, then staked to the Infinity Rising ecosystem contract. Approved DEXs and pairs:- **Uniswap v2 (Eth): RISE/WETH**

- **Uniswap v2 (Base): RISE/WETH**

- **PancakeSwap v2 (BSC): RISE/WBNB**

- **Minswap (Cardano): RISE/ADA**

-

Number of $RISE tokens staked, weighted by duration (Multiplier)

-

Users running nodes (as described in the Hosting section)

-

Gameplay activities (as described in the Gameplay section)

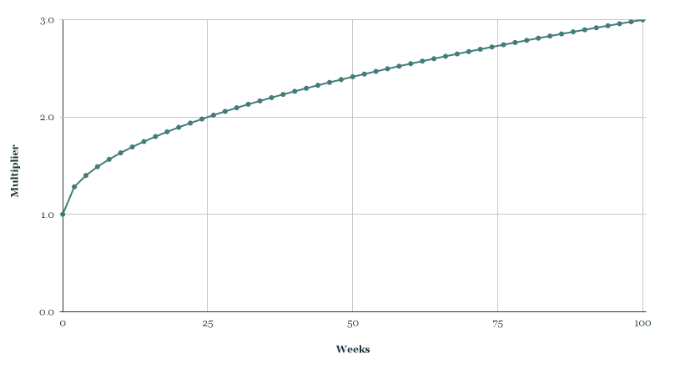

Multiplier Mechanics

For items with a multiplier (LP staking & $RISE staking), define the contribution (C) as a function of the multiplier (M) and tokens staked (T):

We define the multiplier (M) as a function of the staking duration (D) in weeks:

This yields the following curve (multiplier increases over time, capped at 100 weeks):

After the chosen duration expires, tokens remain staked and can be withdrawn anytime;

pools keep accumulating rewards with their original multiplier (e.g., 50-week stake → multiplier based on 50 weeks; 110-week stake → capped at the 100-week multiplier).

Claiming & Spending Rewards

Rewards earned are sent to a smart contract that facilitates one of two actions:

- Claim $RISE to wallet (subject to an early claim fee or a vesting period).

- Spend $RISE freely in the Marketplace on all items.

Replenishing the Reward Pools

Some tokens are redirected from revenue to the Reward Pools:

Example:

- User A purchases products worth 1,000 $RISE.

- Up to 10% of collected fees (100 $RISE) is allocated to replenishing the reward pool.

- The remaining 900 $RISE sustains platform operations.